Coronavirus vaccinations

Since December 2020 the world has embarked upon a mass effort to vaccinate against the Coronavirus pandemic. The leading solutions have been produced by joint ventures led by Pfizer, Moderna and AstraZeneca respectively. Israel and the UAE are amongst the leaders on a per-person basis and are beginning to see a decline in the severity severity and mortality rates amongst its elderly citizens.

Australia is employing a mix of both the Pfizer and AstraZeneca options with priority going to frontline staff and vulnerable groups such as the elderly. The vaccine rollout will reduce the risk of further lockdowns and allow the world to get closer to a “pre-Coronavirus” state. Whilst many countries are adhering to restrictions considerably worse than our own experience, unwinding these will be important to letting a lot of businesses function again particularly in the services industries, such as restaurants and tourism, that are much more reliant on “in-person” experiences.

However, downside risks remain, including:

- Coronavirus mutations weaken vaccine effectiveness. The South African variant does not appear to be adequately countered by AstraZeneca’s solution, as an example.

- Vaccine rollouts are slower than expected due to production or administrative bottlenecks contributing to further fatalities.

US elections

We saw the end of the Trump Presidency succeeded by Democrat nominee Joe Biden. The Biden Administration has issued several Executive Orders to reverse changes implemented under President Trump with a firmer commitment to climate change evident. In addition, there is a strong focus on further fiscal stimulus to support the US economy.

The Administration’s 2021 goals are likely to be informed by:

- Progress in moving past the Coronavirus pandemic.

- Getting another large emergency fiscal package passed to support US households and States.

Beyond these, there are loftier goals to make climate change policy reform and combat inequality through tax reform. There will be challenges here to do more in Congress because, although the Democrats hold a majority, there are procedural tools that the Republicans can use to block legislation.

Australian outlook

Businesses

Australian businesses were major beneficiaries of Government stimulus programs since the Coronavirus pandemic began. JobKeeper has been a major backstop covering the bulk of employee costs. In addition, programs targeting the construction industry (HomeBuilder grants) and also extending depreciation allowances have supported spending.

Other measures targeting business insolvency expired at the end of 2020. These protected small businesses by delaying bankruptcy proceedings for firms going into administration (an initial step before insolvency). 2021 may see those figures start to climb to more normal levels with weakness concentrated in areas such as hospitality.

It is important to note that business failures are a normal part of our economy. For a variety of reasons including poor planning, poor market fit etc, it is difficult to build a functioning business easily.

Could business struggles be even worse than this? While it is possible, we would argue the broad recovery shown in economic data to-date suggests business insolvency is unlikely to be worse at a broader level. The scale of Government stimulus, with the likes of JobKeeper, has played an important role here. In addition, as vaccinations begin to be administered more broadly, and economic activity returns “to normal”, we will likely see a bounce in demand as households gain the confidence to reduce a high savings rate of 18.9% as of September 2020 (down from its record high of 22.1% in June 2020).

Households

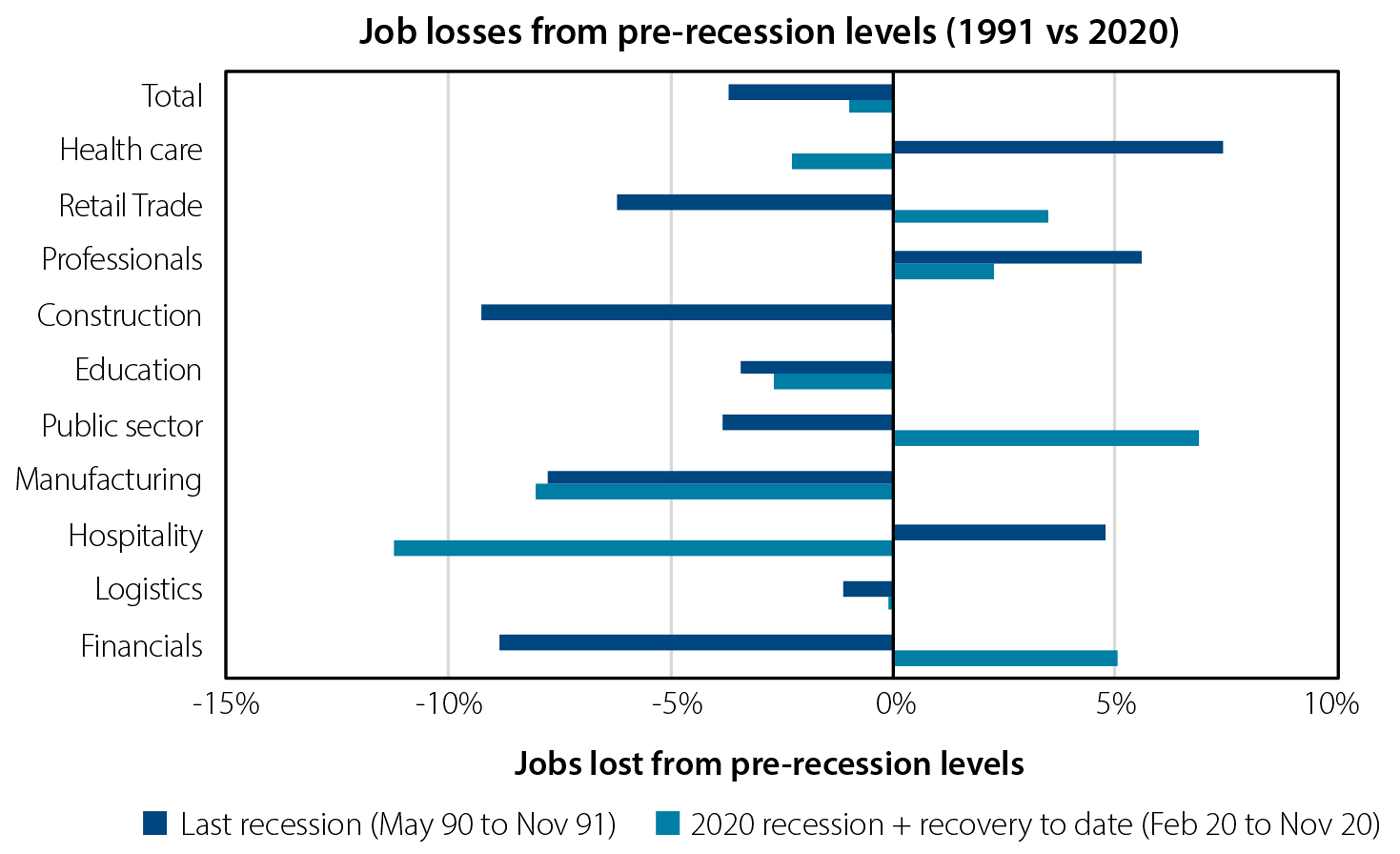

This has been an unusual recession experience particularly compared to our last experience almost 30 years ago. The following graph highlights some notable contrasts. For example, as of November 2020, the hospitality sector has 10% fewer jobs than it did in February 2020. By contrast, the public sector has gained almost 7% more jobs. This compares to hospitality gaining jobs in the last recession and the public sector losing them. The graph suggests the unwinding of government stimulus such as JobKeeper is going to be more firmly felt in regions with greater reliance on tourism such as coastal Queensland. Conversely however the gains in other sectors and falling unemployment suggest an economic recovery is on track. That should see more jobs created overall and help counter the pain that these regions will be experiencing.

Job losses from peak levels comparing 90s recession to 2020 recession

Source: IOOF Research